TPSF applauds industry, agriculture budget reforms

DAR ES SALAAM: THE Tanzania Private Sector Federation (TPSF) in collaboration with other stakeholders have welcomed the proposed 2025/26 national budget, lauding its potential to be a game-changer for the country’s economic landscape.

They applauded the budget’s focus on key sectors such as agriculture, domestic industry and education, noting that the proposed measures could provide much needed relief and stimulus, while bolstering national development.

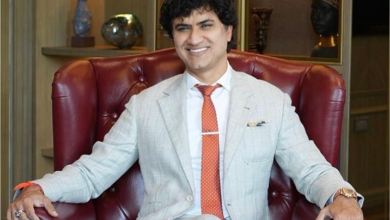

Speaking during the Private Sector Review of the 2025/26 Budget Reforms held yesterday in Dar es Salaam, TPSF Chief Executive Officer Raphael Maganga commended the government for incorporating recommendations that support private sector growth, particularly those aimed at safeguarding and promoting local industries.

Mr Maganga said the proposed 56.49tri/-budget represents a significant shift towards safeguarding domestic industries, which he highlighted as crucial for job creation, expanding the tax base and boosting national income.

“As we know, this year’s budget is substantial and aims to foster development, especially in infrastructure, ensuring that Tanzanian businesses thrive,” said Mr Maganga.

He added: “Some of the proposals within the budget are particularly relevant to the private sector, including the protection of local industries. We welcome this initiative and expect to see substantial investment growth in these sectors.”

The TPSF boss further stressed on the need for the government to support startups by revising tax systems and establishing a private equity fund that will allow them to attract foreign investments, which would enhance the tax base in Tanzania.

“Currently, the framework for attracting capital into the country is not welldefined, leading to many startups to operate outside Tanzania,” he said.

The OASIS Financial Services Limited CEO Stambuli Myovela, commented that the proposed budget reflects the government’s commitment to self-reliance, projecting an increase in domestic revenue collection from 20tri/- in 2020/2021 to 40tri/-.

“This shift aims to reduce borrowing and enhance self-sufficiency,” said Mr Myovela.

He pointed out concerns about the introduction of a 10 per cent withholding tax on retained earnings for companies, noting that it could economically impact firms by limiting their capacity to reinvest profits.

ALSO READ: TPSF: Why is China among the top investors in Tanzania

Moreover, Mr Myovela said the proposed budget increases the withholding tax rate on mining services from 5 to 10 per cent, which could enhance government revenue, although at an additional cost to mining companies.

On her part, the Tanzania Women’s Chambers of Commerce (TWCC) Executive Director, Dr Mwajuma Hamza said that the budget aims to bring about changes that will directly benefit citizens, particularly women.

She pointed to the government’s proposal to remove Value Added Tax on imported gas cylinders, which will promote the use of clean energy and ease living conditions.

Dr Hamza also applauded the reduction of the tax rate from 18 to 16 per cent for those using e-commerce systems, stating it would encourage more entrepreneurs to adopt digital platforms, facilitating business operations and promoting a cashless economy.

Dr Hamza also supported the proposal to eliminate VAT on locally produced edible oil made from domestically sourced seeds, which would help reduce the price of this essential commodity.

Furthermore, she advocated for a zero VAT rate on agricultural inputs, especially fertilisers, to lower acquisition costs and boost agricultural productivity, a critical sector for the nation’s food security.