Govt urges modernized economic activities in line with Tanzania’s growth

DAR ES SALAAM: FINANCE Minister Dr Mwigulu Nchemba has urged individuals and institutions to align their economic activities with the country’s growth as a middle-income economy.

“Tanzania is now a middle-income economy. We cannot afford to have a big economy while our activities remain primitive. We must embrace modern economic practices,” Dr Nchemba stated.

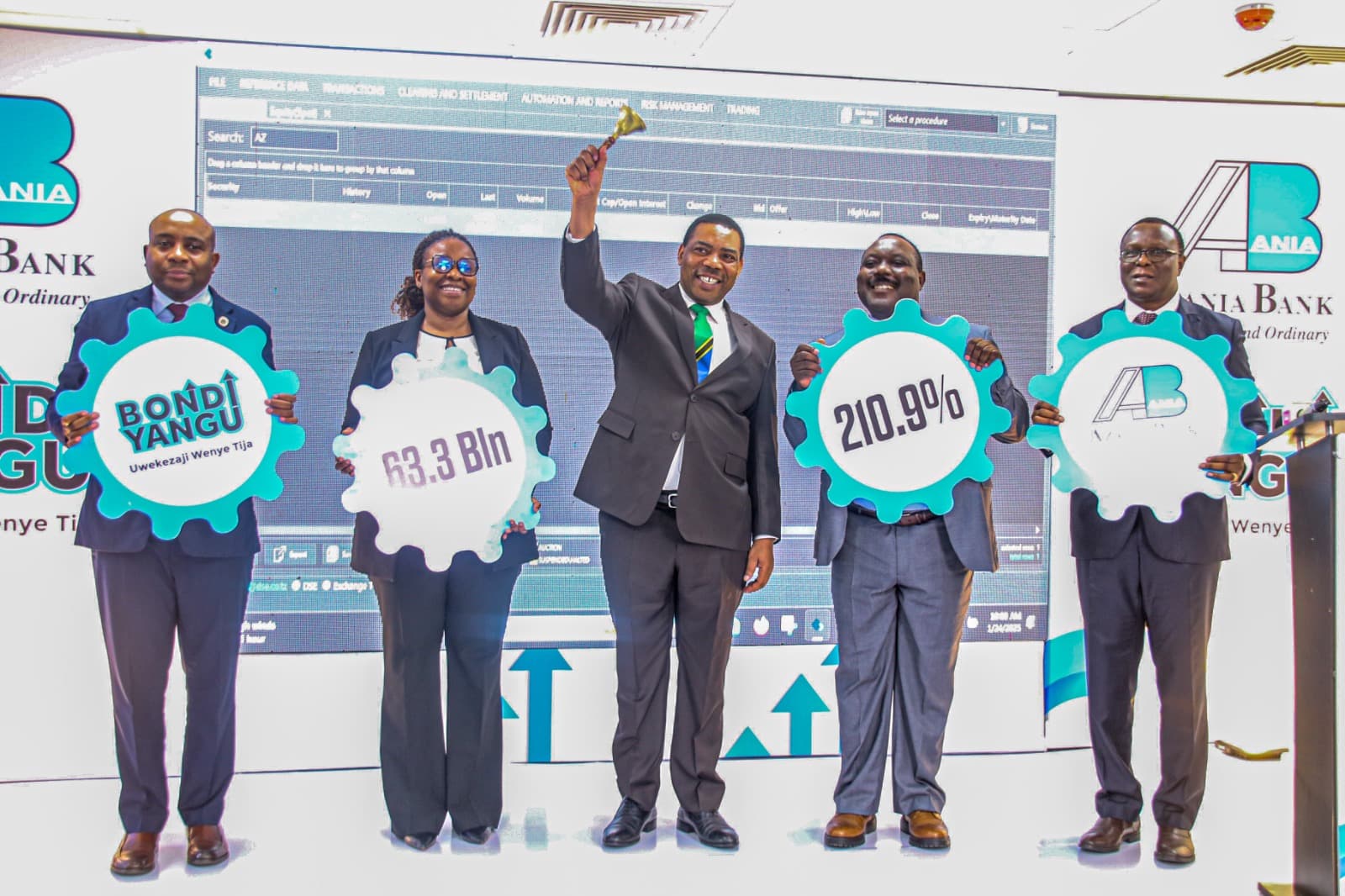

The minister made this call yesterday in Dar es Salaam while officiating the listing of Azania Bank’s bond, named Bondi Yangu, on the Dar es Salaam Stock Exchange (DSE).

He also emphasized the importance of productive investments to sustain and accelerate economic progress.

“To ensure the country’s continued development, we must focus on meaningful and well-researched investments. The government will continue to create a favorable environment for the financial sector, particularly in capital markets,” he said, urging Tanzanians to seize emerging investment opportunities.

Chief Executive Officer of the Capital Markets and Securities Authority (CMSA), Mr Nicodemus Mkama, emphasized the role of innovative financial products in attracting both local and international investors.

Mr Mkama thanked the government for fostering a conducive environment that enables such innovations.

He argued that the success of ‘Bondi Yangu’ signifies strong investor confidence and supports the government’s strategy to enhance alternative project financing strategy.

Azania Bank’s bond, Bondi Yangu, has achieved remarkable success, raising 63.3bn/ in the Initial Public Offering which started in November 4 till December 6 last year-—exceeding its initial target of 30bn/-, equivalent to the performance of 210.9 per cent.

ALSO READ:Mobile money surge drives growth in digital economy

“This demonstrates growing confidence among Tanzanian investors in the financial markets. Such milestones mark significant progress for our capital markets and underscore the importance of financial literacy and inclusion,” noted.

Over five years, Azania Bank aims to raise 100bn/- through this bond in four tranches, with this launched first tranche recording big success.

Dr Esther Mang’enya, Azania Bank’s Managing Director, expressed her satisfaction with the bond’s success.

“This is our first bond issuance, and it has received overwhelming support. The funds raised will be used to provide loans to women, youth, and entrepreneurs,” she

According to Mr Peter Nalitolela, Chief Executive Officer of DSE, the strong investor response highlights the progress of Tanzania’s capital markets.

He noted, “All investors are domestic, which shows growing trust among Tanzanians in financial markets.

He stated that the DSE market capitalization reached 18.64tri/- on Thursday, with over 637,000 investors.

“We aim to triple this number within the next year and a half by leveraging digital platforms, including mobile phones.”