Double Taxation Agreements intricacies (Part 2)

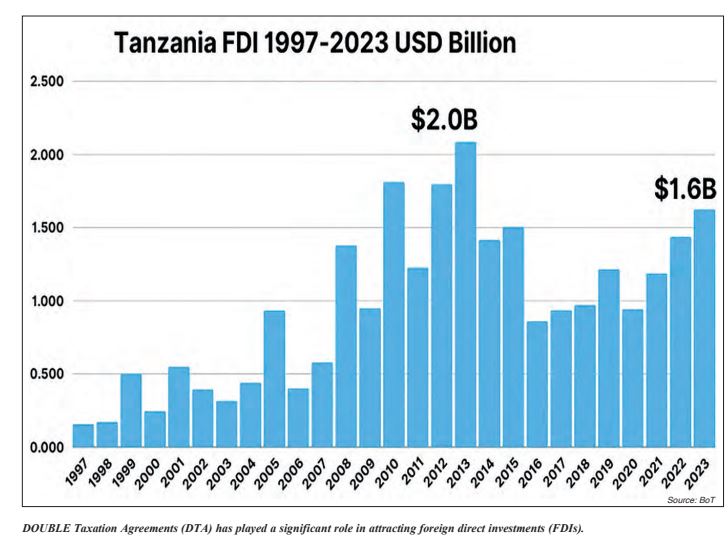

DAR ES SALAAM: TANZANIA’S Double Taxation Agreements (DTAs) play a pivotal role in supporting the country’s broader tax reform objectives by creating an investor-friendly tax environment.

By mitigating tax-related uncertainties frequently identified as significant barriers to foreign direct investments (FDIs) these agreements foster confidence among international investors.

DTAs eliminate the risk of double taxation, promoting a predictable and transparent tax landscape that aligns with Tanzania’s ongoing efforts to modernise its tax system and enhance compliance.

However, as Tanzania’s domestic tax policies evolve, maintaining alignment between treaty obligations and national priorities presents notable challenges.

Building on the January 14th issue, where we explored the role of DTAs in shaping tax landscapes and attracting foreign investments, today we shift our focus to stakeholder discussions highlighting key implementation challenges, including administrative complexities, potential revenue losses and the need for periodic treaty updates to align with evolving economic and regulatory dynamics.

Implementation Issues Managing Director of an engineering company and a former tax consultant, Mr Emmanuel Edwin said that the effective implementation of Double Taxation Agreements (DTAs) in Tanzania faces significant hurdles that diminish their intended benefits.

He noted administrative challenges, including delays in treaty enforcement and inconsistent interpretations of treaty provisions, which create uncertainty for investors.

“These issues are further compounded by insufficient training for tax authorities, leading to inconsistent applications of the same treaty across different cases,” he explained.

“Such inconsistencies not only drive-up compliance costs but also risk undermining investor confidence in the fairness and predictability of Tanzania’s tax system.”

The ex-tax consultant cited the implementation of Tanzania’s DTA with India as a prime example of the challenges investors face and highlighted the case of Bharti Airtel, a prominent Indian telecommunications investor in Tanzania, to illustrate his concerns.

According to him, the revised DTA of 2013, intended to mitigate double taxation by offering tax credits for taxes paid in Tanzania, fell short due to significant delays in obtaining refunds and tax credits in India.

He attributed these issues to administrative inefficiencies and poor coordination between the tax authorities of both countries. Mr Edwin emphasised that such experiences underline the practical challenges of DTA implementation and the critical need for streamlined administrative processes and better bilateral collaboration.

Moreover, conflicts between DTA provisions and local tax laws present significant hurdles. In cases where treaties diverge from domestic tax regulations, ambiguity often arises, leading to disputes and prolonged negotiations between investors and tax authorities.

For example, the lack of clear alignment on income classifications or taxation rights can result in double taxation or under-taxation, defeating the purpose of DTAs. To address these challenges, Tanzania must streamline administrative procedures, invest in capacity building for tax officials and establish clearer guidelines for harmonising DTAs with domestic tax frameworks.

Unintended Consequences Mr Fred Msangi, an MBA graduate, seasoned finance professional and Managing Director of an insurance brokerage firm operating across Tanzania, pointed out a critical concern regarding DTAs.

He stated, “Although DTAs are designed to prevent double taxation, they can inadvertently enable tax avoidance and profitshifting by multinational corporations. Exploitative practices, such as treaty shopping—where companies structure operations to benefit from the most favourable treaty terms—or base erosion and profit shifting (BEPS), are common unintended outcomes.

These practices reduce Tanzania’s tax revenue, undermining the country’s ability to fund essential public services and development projects.”

For instance, multinational corporations may use transfer pricing strategies to shift profits to low-tax jurisdictions, even when the actual economic activity occurs in Tanzania.

This practice not only deprives the country of its fair share of tax revenue but also exacerbates inequality in the tax burden, placing an undue burden on local businesses.

According to Mr Msangi, to address these risks, Tanzania must adopt robust anti-abuse measures, such as limiting treaty benefits to genuine economic activities, enhancing cross-border information exchange and actively participating in global initiatives like the OECD’s BEPS framework. Mr Msangi further cited the Acacia Mining tax dispute as a notable example of the risks associated with multinational operations in Tanzania.

In 2017, the Tanzanian government accused Acacia Mining of engaging in aggressive tax planning strategies, including transfer pricing and profit shifting, to underreport revenues and evade taxes. According to the government, Acacia exported gold concentrates valued at 190 billion US dollars over a 17-year period, while significantly understating the value of these exports in its records.

While this dispute was not directly tied to a specific DTA, Mr Msangi noted that it illustrated the vulnerabilities in Tanzania’s tax framework that could be exploited through treaty shopping.

“Tanzania’s DTAs with countries like Canada and the UK, where Acacia’s parent company Barrick Gold operates, may have facilitated the use of favourable treaty terms to reduce taxable income in Tanzania,” he explained.

ALSO READ: Tanzania double taxation agreements retrospect

Profits from Tanzanian operations could be funnelled through jurisdictions with advantageous tax treaties, eroding Tanzania’s tax base, he said.

In response to the Acacia case, Mr Msangi commended the Tanzanian government’s efforts to implement stricter transfer pricing regulations and renegotiate mining contracts to close loopholes.

However, he emphasised, the case demonstrates the broader need for DTAs to include robust anti-abuse provisions to prevent treaty exploitation and ensure Tanzania retains its rightful share of revenue from economic activities conducted within its borders.”

Economic Dependence

A renowned tax expert, Mr Barita Taseni, along with other stakeholders in the taxation industry, said that while DTAs have been instrumental in attracting foreign direct investments (FDIs) to Tanzania, they have also raised concerns about fostering economic dependence on external capital at the expense of local industry growth.

According to them, the influx of foreign investments, often supported by favourable tax treatments under DTAs, can overshadow the development of domestic enterprises.

“Local businesses, particularly small and medium enterprises (SMEs), often struggle to compete with well-capitalised foreign firms benefiting from the tax advantages provided by DTAs,” Mr Taseni remarked.

The Bagamoyo Port Project is cited as a stark example of how DTAs and foreign investments can lead to economic dependence. The 10 billion US dollars project, envisioned as one of Africa’s largest ports, was led by Chinese and Omani investors under Tanzania’s DTA framework with these nations.

While promising significant foreign capital inflow, the project raised serious concerns about its economic implications, especially for local industries and Tanzania’s fiscal sustainability.

Critics, including Mr Taseni, said that the terms of the investment granted extensive tax exemptions and long lease agreements to foreign entities, potentially undermining local revenue streams and compromising sovereignty over a critical infrastructure asset.

“The reliance on foreign expertise and capital meant limited involvement of local businesses and workers in the project’s development and operation, marginalising domestic economic contributions,” Mr Taseni noted.

In 2019, the late Tanzanian President John Magufuli suspended the project, citing unfavourable terms that disproportionately benefited foreign investors at the expense of Tanzania.

According to Mr Taseni, this decision underscored the risks of over-reliance on foreign investments facilitated by DTAs and highlighted the importance of policies that prioritise domestic value addition, technology transfer and partnerships with local industries.

Mr Taseni and his peers further warned that this dependence on foreign investment exposes Tanzania’s economy to vulnerabilities, such as global market fluctuations, geopolitical shifts and changes in investor priorities. They stressed the need for policies that focus on developing local industries, building domestic value chains and fostering entrepreneurship.

“To mitigate these risks, Tanzania must prioritise technology transfer, capacity building and partnerships between foreign investors and local businesses,” Mr Taseni advised.

“Establishing industrial policies that promote local value addition and incentivise domestic investment is critical to creating a balanced and resilient economy.”

Comparative Analysis

A professor from the University of Dar es Salaam, a seasoned expert in taxation and international tax law, who preferred anonymity, observed that Tanzania’s approach to Double Taxation Agreements (DTAs) reflects both similarities and differences compared to neighbouring countries and other nations in similar economic contexts.

The scholar said that analysing the strategies employed by countries such as Kenya, Uganda and Rwanda in East Africa, alongside Zambia and Ghana, offers valuable insights into leveraging DTAs to foster economic growth while maintaining a balance with domestic fiscal priorities.

He went on to elaborate on Tanzania’s approach to Double Taxation Agreements (DTAs), offering a comparative analysis with neighbouring countries.

“Kenya has a relatively more extensive DTA network than Tanzania, with agreements in place with over 20 countries as to my understanding, including key partners like China, India and Germany,” he explained.

“Kenya’s DTAs often include anti-abuse provisions, such as limitations on treaty benefits, which aim to curb treaty shopping and profit shifting by multinationals. Its implementation of the OECD’s Base Erosion and Profit Shifting (BEPS) Action Plan demonstrates a proactive approach to addressing global tax challenges.

Tanzania, while working to expand its DTA network, has yet to adopt comprehensive anti-abuse measures like Kenya, leaving it more vulnerable to treaty exploitation and revenue loss.”

The University don also noted Uganda’s approach, stating, “Uganda has fewer DTAs than Tanzania but places significant emphasis on aligning treaty terms with domestic tax priorities.

For example, Uganda has renegotiated several treaties to include minimum tax rates on royalties and interest, ensuring a fairer share of revenue from foreign investments. Its partnerships with international organisations, such as the IMF, have further helped streamline tax treaty processes.

This focus on renegotiation provides Tanzania with a blueprint for keeping DTAs equitable as economic conditions evolve.” Moving to Ghana, he highlighted its strategies as another resource-rich country: “Ghana uses DTAs strategically to attract foreign direct investment, particularly in mining and energy.

Its treaties emphasise transparency and incorporate robust informationsharing mechanisms between tax authorities. Ghana’s adherence to international best practices, such as joining the Inclusive Framework on BEPS, has strengthened its ability to address tax avoidance schemes.

This serves as a potential model for Tanzania to bolster enforcement and improve treaty effectiveness.” Regarding Rwanda, he noted its sector-specific approach: “Rwanda has strategically negotiated DTAs with a focus on sectors that align with its national development goals, such as technology and services.

For instance, its DTA with Mauritius includes provisions for dispute resolution, enhancing investor confidence. Tanzania could learn from Rwanda’s sectoral focus by tailoring its DTAs to target high-growth industries like manufacturing, agriculture and renewable energy.”

These comparative insights, as shared by the professor, underline the importance of adopting tailored and proactive strategies to maximise the benefits of DTAs while minimising risks of exploitation and revenue loss.

PostScript

Enhancing Tanzania’s Double Taxation Agreements (DTAs) necessitates a strategic and balanced approach that effectively attracts foreign investment while safeguarding national revenue interests.

Key priorities include incorporating robust anti-abuse provisions to prevent treaty exploitation, renegotiating outdated treaties to align with current economic priorities and strengthening administrative capacity to ensure efficient implementation and enforcement.

More importantly, advancing evidence-based policymaking is essential. This requires comprehensive research into the economic, administrative and sectoral impacts of DTAs to identify successes, challenges and areas for improvement.

By adopting a forward-thinking and data-driven approach, Tanzania can optimise its DTA framework to support sustainable economic growth and align seamlessly with the country’s broader tax reforms and development objectives.

• Share your voice and join the conversation by calling 0655963224 or emailing your thoughts to kelvinmsangi@protonmail.com. Your insights are essential in building a tax system that is fair, efficient and beneficial for all Tanzanians. We value your input and look forward to including your feedback in our ongoing discussions on tax reform.