Public entities to remit up to 40 pc to govt

DODOMA: PUBLIC entities will now remit up to 40 per cent of their gross revenues to the Consolidated Fund, instead of the 15 to 60 per cent, initially proposed by the government.

The agreement was reached between the government and National Assembly after a heated debate, during which the legislature argued against the executive’s proposal, deeming it too high.

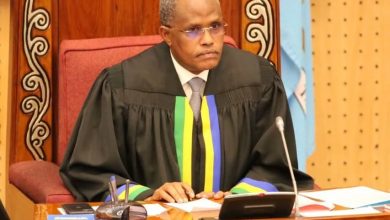

A prolonged debate took place between lawmakers, led by Speaker Tulia Ackson and the government, headed by Finance Minister Dr Mwigulu Nchemba, Attorney General Johari Hamza and other sectoral ministers, during the passing of the Finance Bill, 2025.

The bone of contention was the government’s proposed amendment to the Treasury Registrar (Powers and Functions) Act, Cap. 370 and the Public Finance Act, Cap. 348.

The proposed provision stated that executive agencies, public corporations and public institutions that charge fees for services must remit between 15 and 60 per cent of their gross monthly revenue to the Consolidated Fund.

However, presenting its opinion on the proposed Finance Bill, 2025, the Parliamentary Budget Committee strongly opposed the government’s proposal to raise the remittance.

The committee revealed that it had engaged in extensive discussions with the government and raised a number of concerns regarding the proposal.

The Vice-Chairperson of the Committee, Mr Twaha Mpembenwe noted that the proposed changes lacked clear legal criteria to determine which public institutions or organisations would be required to contribute at the new rates.

It also observed that the government had not submitted any technical or professional analysis to support the proposed adjustment.

Furthermore, the committee said the move was inconsistent with directives issued by President Samia Suluhu Hassan during a past event to receive dividends from public institutions.

ALSO READ: Treasury Registrar’s Corner: How public entities can flourish globally

During the Gawio Day held early this month, the president stressed the importance of supporting public institutions so they can grow and contribute more effectively to national development.

According to the Committee, the proposal risks placing additional financial strain on institutions that are already facing difficulties meeting the current 15 per cent requirement.

“The contribution is calculated from gross revenue without taking into account operational expenses. Raising the rate to between 15 and 60 per cent could significantly affect the performance of many institutions,” Mr Mpembenwe stated.

The committee added that some public institutions rely on consistent cash flow to service loans for development projects, and the proposed policy could disrupt those operations.

The committee also raised concern over existing weaknesses in expenditure management within some public institutions, noting that instead of addressing those shortcomings, the government was proposing a blanket contribution increase.

Contributing to the debate, nominated MP Shamsi Vuai Nahodha echoed the committee’s concerns, urging the government to nurture and strategically safeguard public institutions to ensure greater returns in the future.

Vunjo MP Dr Charles Kimei added his voice to the debate, warning that the proposed measure would reduce liquidity in parastatals and expose them to greater financial losses.

While many legislators who contributed to the Finance Bill proposals backed the Budget Committee’s position, Speaker Tulia remained firm that the government must introduce a specific cap, rather than the proposed range of 15 to 60 per cent put forward by the Ministry of Finance.

“We cannot hand over our law-making authority to anyone else. If we leave this as vague as it is, someone else will be free to decide as they please and that would amount to surrendering our legislative responsibility, which we cannot allow,” Dr Tulia said.

“You should propose a definitive cap, and it must not be the suggested 60 per cent, as the committee has already made it clear that such a figure would be too high and could undermine the performance of our public entities,” she added.

Despite the government’s explanation that the amendment followed a thorough review of the performance of public entities and that no way the government or Treasury Registrar (TR) would derail the performance of parastatals, both the Speaker and MPs maintained their position.

Eventually, the State Minister in the Prime Minister’s Office – Policy, Coordination and Parliamentary Affairs, William Lukuvi, presented a revised government proposal of a 40 per cent cap, citing the Tanzania National Parks (TANAPA) model, which allocates 40 per cent to the Consolidated Fund.

The proposal was accepted, bringing the debate to a close, as the august House passed the Finance Bill 2025.