DSE edges higher as banks lead trading

DAR ES SALAAM: EQUITIES on the Dar es Salaam Stock Exchange rose modestly Wednesday, with banks extending recent gains as investors focused on a small number of liquid counters while bond trading continued to absorb the bulk of market value.

Total equity turnover reached 4.47bn/-, with 2.24 million shares changing hands across 2,836 deals, reflecting steady participation early in the year.

Trading activity was reinforced by strong demand in the bond market, where government and corporate securities worth 18.81bn/- were exchanged, underscoring investors’ continued appetite for fixed-income instruments.

CRDB Bank dominated equity trading, once again emerging as the most active counter on the exchange. About 821,338 shares were traded on the normal board at a weighted average price of 1,640/-, while an additional 1.03 million shares crossed the block trade board.

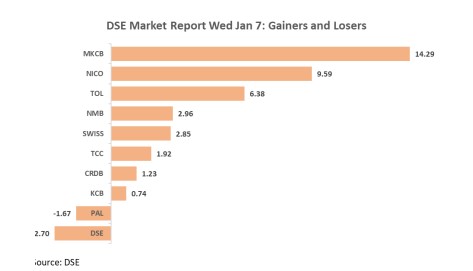

The stock opened at 1,620/- and closed higher at 1,640/-, reinforcing its position as the market’s primary liquidity driver and a key barometer of investor sentiment. Other banking stocks also posted significant gains, led by MKCB Bank Group Plc, which emerged as the day’s top gainer.

The lender’s share price surged 14.29 per cent to close at 4,000/- up from 3,500/-. This advance extends a powerful rally that has gathered momentum throughout the week.

The stock had already signalled strong demand on Tuesday with a 10.8 per cent jump. Wednesday’s trading suggests sustained investor appetite following that initial breakout, with recent gains reflecting heightened confidence in the bank’s turnaround strategy and future earnings trajectory.

ALSO READ: RC forms task force to fast-track stalled projects

NICO Holdings Plc rose 9.59 per cent, becoming the second-top gainer after leading gains on Tuesday, and Tanzania Oxygen Ltd (TOL) increased 6.38 per cent, reflecting continued investor interest in select mid-cap stocks. NMB Bank Plc added 2.96 per cent, supporting the sector’s overall strength.

Trading in DCB Commercial Bank remained stable, indicating selective positioning across banking names rather than broad-based speculation. Outside financials, consumer and telecom stocks recorded mixed but generally positive movements.

Tanzania Breweries Ltd and Tanzania Cigarette Company edged higher, benefiting from steady demand for defensive consumer names, while Vodacom Tanzania Plc saw solid turnover, with investors maintaining exposure to the telecom sector amid expectations of resilient cash flows.

Mid-cap activity was supported by Afriprise Investment Plc, which posted relatively heavy volumes, contributing to broader market participation even as price movements remained measured.

On the downside, DSE Plc, the exchange’s own stock, retreated modestly, giving back some recent gains, while PAL Ltd also closed lower, highlighting pockets of profit taking in less liquid counters.

Exchange-traded funds remained active, with the VERTEX ETF trading over 212,000 units at 400/- pointing to continued interest in passive exposure to the broader market.

Market benchmarks extended their upward trend, with the DSE All Share Index rising to 2,877.45 and total market capitalisation approaching 25tri/-, supported largely by gains in financial heavyweights.

Investor flows showed a clear divergence, with local investors accounting for nearly nine-tenths of buying activity, while foreign investors dominated the sell side, a pattern consistent with offshore profittaking and increased domestic accumulation.

The latest session reinforced the banking sector’s central role in shaping market direction, with CRDB providing liquidity and MKCB emerging as a key momentum stock.

As trading volumes stabilise and fixed-income demand remains strong, investors are likely to continue favouring fundamentally solid names while selectively rotating into high-growth opportunities.

This dynamic suggests that market performance will increasingly be driven by a combination of liquidity support, corporate fundamentals, and targeted sectoral opportunities rather than broad-based speculation.