COLUMN: THE CLIFF. Bank of Tanzania: An 88.8pc CBR hold

TOMORROW, the Bank of Tanzania (BoT) will hold its seventh Monetary Policy Committee (MPC) meeting since introducing the Central Bank Rate (CBR) in January 2024.

With the benchmark rate currently at 6.0 percent, this decision arrives during a period of relative domestic calm, yet with heightened interest from economists, investors, and policymakers—especially with general elections just three months away.

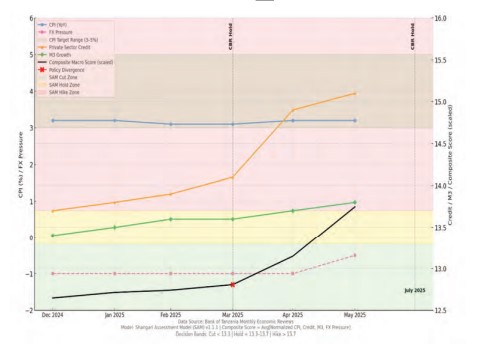

The core question, as W. Edwards Deming famously quipped, isn’t just “what will the BoT do?”, but rather, “what will the data compel them to do?” It’s precisely this data-driven inquiry we’ll delve into today. To make sense of all this and help us predict what the BoT might do, I built something called the Shangari Assessment Model (SAM v1.1.1). Think of it as our in-house crystal ball, but one that uses real numbers.

It crunches various economic data – like inflation, how much money people are borrowing (credit growth), what’s happening with foreign currencies (FX), how much cash banks have (interbank liquidity), and even what other central banks globally are up to. By feeding all this into SAM, we get a good idea of the chances – the probabilities – of the BoT holding rates steady, raising them, or even cutting them.

SAM’s predictive power is fundamentally rooted in the BoT’s own historical policy trends.

Since its introduction, the CBR’s policy history has been notably stable. After the initial rate was set at 5.5 per cent in Q1 2024, BoT implemented a single hike to 6.0 percent in Q2, prompted by inflationary pressures and foreign exchange depreciation.

ALSO READ: COLUMN: NEW THINKING. Is GDP per capita enough to measure well-being?

Since then, the central bank has held the rate constant across four consecutive quarters, suggesting a clear preference for policy continuity when inflation is well-behaved and liquidity remains adequate.

Recent macroeconomic data continues to support this holding bias. The BoT’s Monthly Economic Reviews for March, April, and May 2025 report headline inflation averaging 3.17 per cent—comfortably within the BoT’s informal target range of 3.0 to 5.0 per cent.

Core inflation indicators remained stable, suggesting no embedded inflationary trend. Meanwhile, private sector credit expanded robustly, growing at an average annual rate of 14.7 per cent, with particularly strong uptake in agriculture, trade, and construction.

These figures indicate that monetary transmission remains intact and that businesses continue to access credit at prevailing rates. The Tanzanian shilling did experience mild depreciation over the three-month period, but not at levels that would prompt immediate monetary action. Interbank liquidity remained stable overall, through there were signs of marginal tightening among smaller banks in May.

However, this was assessed as a temporary segmentation issue rather than a systemic liquidity squeeze. Broad money supply (M3) growth averaged 13.7 per cent, a rate consistent with supporting economic activity without igniting excess demand.

On the fiscal side, government deposit trends and expenditure patterns showed no signs of placing pressure on domestic liquidity, and there was no evidence of crowding out. Tanzania’s policy stability gains support from the global monetary environment. While major central banks are signaling neutrality or modest easing, thus removing external monetary pressures on the nation, the international backdrop is nonetheless nuanced.

As of June 2025, the Council on Foreign Relations (CFR) Global Monetary Policy Tracker shows significant divergence: 21 of 54 central banks cut rates, 29 held, and just 4 hiked. Europe, led by the ECB and Swiss National Bank, notably eased to foster growth and counter disinflation. Conversely, North America, Asia-Pacific, and the Middle East largely remained neutral.

Sub-Saharan Africa presented a mixed picture, with Nigeria hiking rates while Kenya and Ghana began easing. This global variation underscores that the BoT’s domestic policy must be interpreted within this complex international context.

SAM, leveraging Bayesian inference, processes new data to update its predictions. For Q3 2025, the model forecasts an 88.8 per cent probability that the Bank of Tanzania (BoT) will hold the Central Bank Rate (CBR) at 6.0 per cent. There’s an 11.2 per cent chance of a hike, with a cut being virtually zero.

ALSO READ: Tick size reforms revive stock volatility

This strong inclination towards a hold is primarily due to contained inflation, robust credit growth, a stable exchange rate, and the absence of external or fiscal stress. In essence, current policy signals overwhelmingly support maintaining the status quo.

That said, the risk of a rate hike—while small—is not entirely absent. BoT has a track record of responding swiftly to exchange rate volatility and liquidity stress when warranted. Should FX pressures intensify, or if signs of interbank fragmentation deepen beyond the small-bank segment, a hike would become more likely.

Conversely, a rate cut would only be justifiable under very specific circumstances: a drop in inflation below 3 percent, a clear deceleration in credit growth, or a significant loosening of global financial conditions. None of these conditions are currently in place. The implications of a continued rate hold are significant for Tanzania’s financial system. For commercial banks, unchanged policy means no shift in funding costs, which allows for continued expansion in lending portfolios—particularly in agriculture and trade.

Stability in the policy rate also anchors short-term yields, supporting consistent pricing in government securities markets Investors, both local and foreign, are likely to view this as a sign of monetary prudence, helping sustain confidence in Tanzanian debt markets and reducing reinvestment risk on the short end of the yield curve. For borrowers in the private sector, stable interest rates provide planning certainty and preserve affordability, especially for working capital and investment loans.

Meanwhile, fiscal authorities benefit from the absence of crowding-out pressure, as monetary-fiscal alignment remains intact. In a forward-looking sense, the tone and language of the upcoming MPC statement will be worth close examination. If references to “tight liquidity” or “upside inflation risk” appear, this could suggest a tilt toward tightening in Q4, especially if market conditions shift.

Treasury bill yields particularly the 91-day and 364-day tenors—will also offer early indications of how markets are pricing future decisions. Additional insights can be drawn from the upcoming IMF Article IV consultation, which will shed light on external views of Tanzania’s inflation framework, FX flexibility, and fiscal-monetary coordination.

ALSO READ: COLUMN: WEEKLY INVESTMENT TALK. Retained earnings and efficient asset allocation

Watching these cues will be crucial for market participants aiming to anticipate policy inflection points. From a sectoral standpoint, the stability in the CBR is especially supportive of lending momentum in agriculture, trade, and construction three sectors that have consistently absorbed credit growth in recent quarters. Manufacturing and consumer credit are also likely to sustain moderate momentum, as borrowing conditions remain accommodative and household balance sheets appear resilient.

These dynamics indicate that monetary neutrality is working in tandem with credit transmission and sectoral real economy needs. For investors, the message is clear. Policy predictability is prevailing. The likelihood of a hold supports fixed-income positioning strategies, encourages continued participation in primary auctions, and reinforces investor confidence in BoT’s inflation management.

With FX risk subdued and monetary tightening off the table for now, reinvestment conditions for short- and medium-duration debt remain stable. Meanwhile, real rates are still positive, which supports currency value and market participation without eroding purchasing power.